How to Get Your Finances Ready for Military Retirement

Military retirement changes life in big ways. The service member is leaving a long-term career, you may move, and your income will be different.

Being prepared for the financial changes can help make the process a little smoother.

Your Post-Retirement Budget(s)

The first step in retirement financial planning is to build two post-retirement budgets.

The first budget is the “for sure” budget and includes only income that is (somewhat) guaranteed. This would be military retirement pay, spouse employment that will continue through the retirement process, and any other consistent income like a rental property or a side hustle. Spending on this budget will probably be limited mostly to essentials.

The second budget is the ideal budget and includes the desired post-retirement income, including the service member’s post-retirement job, a new job for the spouse, and/or VA disability compensation. This budget will include more spending on non-essential items and reflect your desired lifestyle.

It’ll take a little research to build these budgets. You need to learn:

- What your take home retirement pay will be after factoring in taxes and Survivor Benefit Plan (SBP) premiums, if elected

- How your TRICARE costs will change as a retiree

- The cost of living at your new location (if you are moving)

- Whether and how your taxes will change after retirement

While both budgets are important, it is the “for sure” budget that will drive the rest of the financial plan for the military retirement process. The more realistic you are about this budget, the less likely you’ll run into situations that you’re not financially prepared to face.

If you're nearing retirement and wondering how much money you'll need, a military retirement calculator such as those provided by the DoD or Military OneSource can help provide insights into your financial readiness.

Image from Canva

Image from Canva

Your Income Timeline

Knowing when what pays will stop and start is helpful.

Your last active duty military paycheck is calculated as if it arrives on the first payday after the last day of active service. For a longevity retirement that happens on the 1st of the month, the pay you receive on the 1st (or a few days before) is your last paycheck. However, it is standard for that paycheck to be held a few days or a few weeks for audit. You will likely receive a Leave and Earnings Statement that lists out the usual things, and then shows that the pay is being held.

In rare cases, those few days for audit can turn into a few months. It happens enough that you want to be prepared for the possibility.

If you sell back leave, that is usually paid out within a few days of your last day of active duty. But, of course, that can always be delayed.

The first military retirement pay should be deposited on the first day of the month following your retirement. For example, if you retired on 1 June, the first military retirement pay should be received on 1 July.

Once again, this happens as expected for most people. But the percentage of people whose first military retirement pay is delayed is high enough that you should be prepared for it.

If you are awarded a VA disability compensation rating, when those benefits will happen will depend on when you file the claim and how the VA is moving at the time.

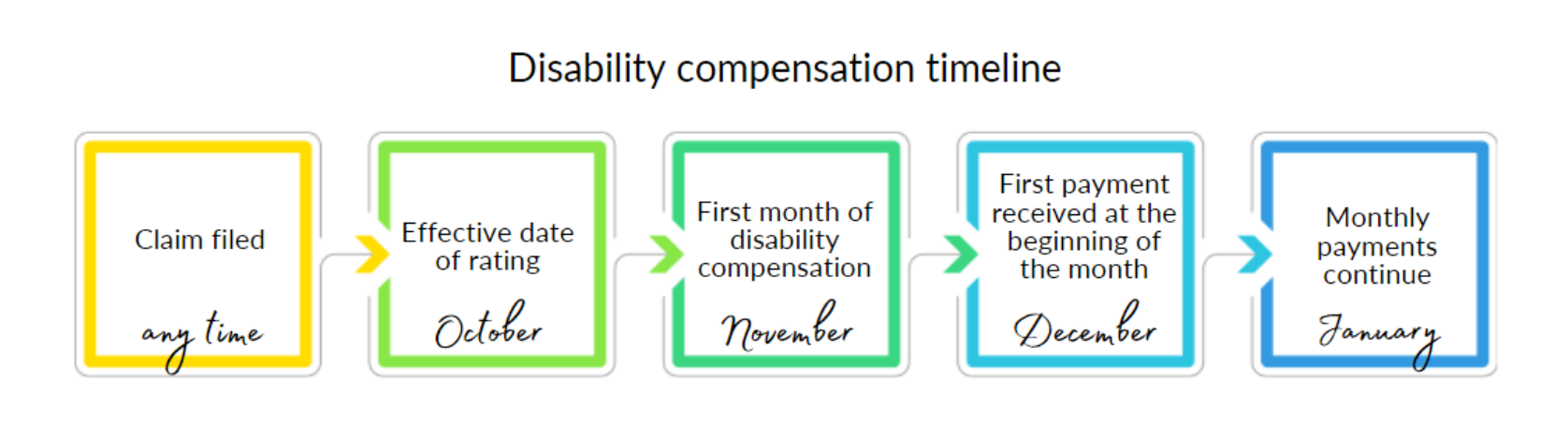

The earliest you can receive a VA disability compensation deposit is the first of the month following the month after retirement. No compensation is paid for the first month. Then benefits are paid in arrears. Here is an example - though your situation may be different.

Image from Kate Horrell

Image from Kate Horrell

For example, if you filed early under the Benefits Delivery at Discharge process, and your rating is effective on the first day of retirement, then your compensation begins on the first day of the following month. But it is not paid until the end of that month.

If you file for VA disability compensation after retirement, you can anticipate a few months for the claims process. Once that rating is awarded, benefits will be paid retroactive to the date of the rating.

If you or your spouse are planning to pursue a new career, remember that job hunting takes time. There is a rule of thumb that says that for every $10,000 in income you expect to earn, you should plan for one month of job hunting. So if you are looking for a $60,000 per year job, the average job hunt will take six months. Obviously, your experience will be more or less than six months. But it is good to have realistic expectations going into the job search.

Once you get hired, it could be several weeks before you start working, and possible several weeks after that before you get paid.

Image from Canva

Image from Canva

Your Transition Fund

Now you can figure out how much money you want to have saved to get you through the retirement process.

Once you’ve created your “for sure” budget, then you need to see if you have a shortfall between income and expenses. Don’t worry if you do; that’s why you plan ahead. How many months do you want to cover? Many people want to have a year’s worth of money to cover the differences between income and expenses in their minimal budget.

You also need to factor in some extra for delays in receiving those “guaranteed” forms of income. The last active duty retirement pay and the first military retirement pay may be delayed, sometimes a surprisingly long time. You want to be prepared for the worst and pleasantly surprised when everything goes well.

Don’t forget that you’ll have some extra expenses during transition. You may be buying or renting a new property, and we all know how many costs come with a new home, changing vehicle registrations, or buying a new work wardrobe.

It’s common to want to lump your transition fund in with your regular emergency fund. Resist this urge! Regular emergencies don’t stop happening just because you’re somewhere in the military retirement process. Transmissions still go out, kids still sit on their glasses, and family members still get sick. You’ll want to have the separate funds to handle these surprises without dipping into the money that’s supposed to get you through this time of change.

Planning ahead for the financial challenges that come with military retirement is the key to weathering those challenges without undue stress or tight situations. No matter where you are in your career, start thinking now about how to prepare for the retirement transition. It’s a biggie, and preparation makes it easier.