What 2018 Real Estate Trends Mean for Military Families

If you’re a millennial living in the South, 2017 was a year all about you and your real estate endeavors. As 2018 begins, it seems that both affordable southern real estate and millennial preferences will continue to significantly affect real estate trends on the whole.

Finding the perfect home was tougher in 2017 because inventory remained low and price points for both rentals and houses remained high. Real estate professionals are forecasting a slow fix to these problems, but the new tax reform will dictate undetermined trends.

The good news for military families is that markets near the largest military installations like The Pentagon, Fort Bragg, and Joint Base San Antonio are strong and offer many options for rentals and home purchases.

If you’re thinking of a change of real estate in 2018, don’t go into any transaction without plenty of research--starting with MilitaryByOwner resources.

The Effect of Millennials on the Real Estate Market

The millennial force is strong and continues to influence real estate in numerous ways. As the oldest group within the generation approaches their 30th birthdays in 2020, everything from rental costs to sought after locations is affected by their preferences because they are the largest group of buyers and renters today.

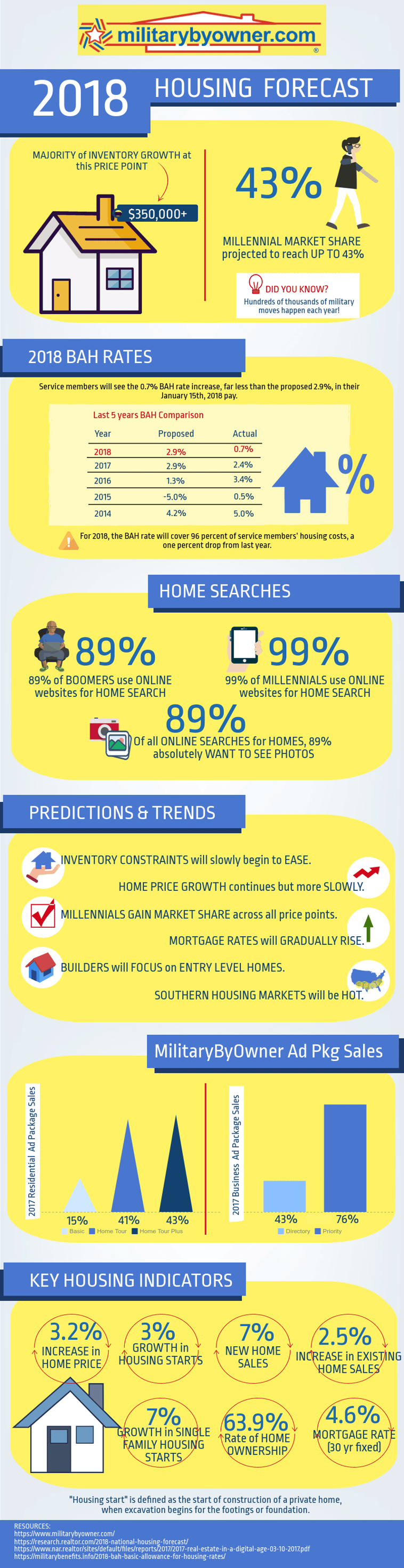

Millennials will buy their share of mortgages from price points starting at the bottom and working up until interest rates and unaffordable home prices weed them out. Realtor.com estimates that 43% of home buying millennials will exist by 2018’s end.

The concept of "surban" communities is taking hold across the country as millennials leave the cities to find more affordable real estate closer to the suburbs. Basically, they are looking for the best of both worlds: walkability to local shops, great schools to start their families, and in general, more space. Mass transit options are also on their wish lists, as they choose to live further from their workplaces to find the ideal mix of livability complete with town center and mixed housing styles.

Once the destination is chosen, millennials lead all groups of buyers who, at minimum, are interested in home technology, but require automated help within the house before an offer is made. Tech found in apps and devices control functions such as the amount of light let in from window blinds to efficient sprinkler systems. In fact, scanning home advertising for lists of technology within the property is likely one of the first mental notes this group makes.

High Rents and Lack of Rental Home Availability

From an economic standpoint, Americans should have embraced home ownership again as the economy recovered after the Great Recession. With unemployment down, interest rates still attractive, and general economic growth, all signs point to buying a home, but this isn’t the case.

Younger millennials haven’t reached the time in their lives when they’d like to establish permanency, but they still want to rent single family homes. Student loan debt and the desire to travel further fuel rental markets.

The 55 and up crowd also prefers to rent and in record numbers. The economic burdens of down payments and home maintenance are lifted, allowing tighter retirement budgets to stretch further. Although the responsibility of owning a home decreases with a rental, the older generation still prefers renting a house to renting an apartment, perhaps due to being accustomed to the freedom and space a single family home offers.

The battle between the generations drives up monthly rental payments and constricts inventory, producing a large rental real estate economy that offers the benefits of better maintained neighborhoods and the burgeoning of property management businesses. Conversely, there are negative attributes associated with the dominance of renters vs. home buyers. Social interaction and general investment into the well being of the neighborhood often decreases without the responsibility of home ownership.

Trends in Military Markets

MilitaryByOwner has partner real estate agents near military bases across the United States. A few have shared insights on trends around their popular military towns.

San Antonio, Texas

Photo by Matthew LeJune on Unsplash

In "Military City USA," San Antonio real estate professionals The Litton Group note the significant year over year growth in both the number of homes sold and in the average median price points. The economy is strong and growing, as is the ever-present military contingent of home buyers and renters.

Military members appreciate the affordability of homes in San Antonio, where the median price point is near $220,000. The mix of quality schools, easy access to health care, and entertainment amenities round out the top reasons to live in, and near San Antonio.

Renters, however, will notice high monthly payments. Karina Gafford, co-owner of The Litton Group, gives her advice on whether to rent or buy in San Antonio: “The influx of people into the city keeps rental rates extremely high with big annual increases, so it's generally more affordable to buy than to rent.”

The expectation for 2018 is the continued growth in all aspects of the local economy, not just from the influence of a military community. Technology and medical sectors are thriving, as is commercial development and increased investment into the arts scene.

Fayetteville, North Carolina

As mentioned previously, southern real estate is driving growth and Brandon Purdeu of the Maison Real Estate Group happens to be right in the middle of a southern market that is home to Fort Bragg and Pope Field near Fayetteville, North Carolina.

As one of the Army’s largest installations, real estate around the greater Fayetteville area is as varied as the troops that make up the community. Brandon offered his thoughts on the current state of the market and the trends he anticipates for the new year.

- Looking toward 2018, we can expect to see a seller's market continue in the greater Fort Bragg area. The hottest markets are showcased in Southern Pines, Cameron, and Raeford.

- New construction continues to dominate, as there is a shortage of updated homes in the area. While inventory is tight, prices are not inflated in the majority of markets.

- Rental price points continue to be stable, with a range of affordable options, especially in Fayetteville and Raeford.

Alexandria/Northern Virginia

Photo by Marina Orpinelli on Unsplash

Kristy Crombie of McEnearney Associates has in-depth knowledge of Alexandria, because it is her home town and she has years of experience living and working in the region. As a military spouse with PCS experience, she's also knowledgeable about what families need to know before moving to Northern Virginia.

She reports Northern Virginia’s real estate market ended 2017 on a positive trend, although inventory was lower than in years past. A seller’s market remains in play, but buyers can still take advantage of competitive mortgage rates.

Due to the proximity to Washington, D.C. and many military installations, rental prices tend to be high. Alexandria is an area rich in history and beauty and has access to quality public transportation. The city and its suburbs offer a wide variety of apartments, condos, townhouses, and single family homes.

In Alexandria, older construction (commercial and residential real estate) are being replaced by mixed-use neighborhoods featuring townhouses, condominiums, retail space, and restaurants, allowing for amenities to be within walking distance. Kristy says, “Neighborhoods and mixed use communities are often rated on a walkability score…people are busy and want convenience. A high walkability score can really add value to a home.”

Washington, D.C.

Photo by Jorge Alcala on Unsplash

Photo by Jorge Alcala on Unsplash

James T. Kim is also with McEnearney Associates, and gladly shares his expertise in matching military families with Washington, D.C. homes. He feels strongly about advising buyers regarding the pros and cons of utilizing a VA loan within the city limits.

Because the D.C. market is so different from the surrounding cities, he firmly advises finding a qualified agent who is very familiar with the entire VA loan process. D.C. has extremely limited inventory, and it's not uncommon for all cash transactions to occur. He reports that approximately 1 out of 5 homes in 2017 were paid for without the use of financing.

James encourages buyers to confirm the age of properties, especially condos when obtaining financing from the VA. He says, “When looking at condos, save everyone trouble by first verifying that the building is VA-approved. Most of our buildings in D.C. are old enough to the point that they are either approved, or it is clear that the VA will not approve them. Sometimes, the building name or address alone is not enough.”

Lastly, D.C. buyers should be aware that the District has stringent fair housing laws, even more so than the rest of the country. D.C. has 11 protected classes in addition to the seven federally protected.

What’s Ahead for 2018

Photo by Blake Wheeler on Unsplash

Photo by Blake Wheeler on Unsplash

Slowly, inventory options for buyers will begin to widen and home prices will lower. For renters and first time buyers to feel confident in making the move to home ownership, they’ll need to see a steady expansion in home inventory and a price drop continue.

Millennials will continue to dominate real estate trends, simply by the large numbers of the age group looking for real estate options that suit their lifestyles, especially in the lower priced South and Midwest. Expect current trends and mortgage rates to react as the new tax reforms are put into place.

As the next PCS season approaches and the spring home sale market emerges, it’s time to research MilitaryByOwner’s collection of information on all topics real estate! From prepping your home for the best sale possible to taking a house hunting trip to your next station, they’re all available in the Resources and Blog sections of the website.

Download and share MilitaryByOwner's 2018 Housing Forecast! Simply use the code below to embed on your site.