The Hidden Costs of Selling Your Home

When it’s time to sell, most military homeowners want to know the answer to several critical questions:

- How quickly can I sell my home?

- How much money will I make when I sell my home?

- How much are closing costs for the seller?

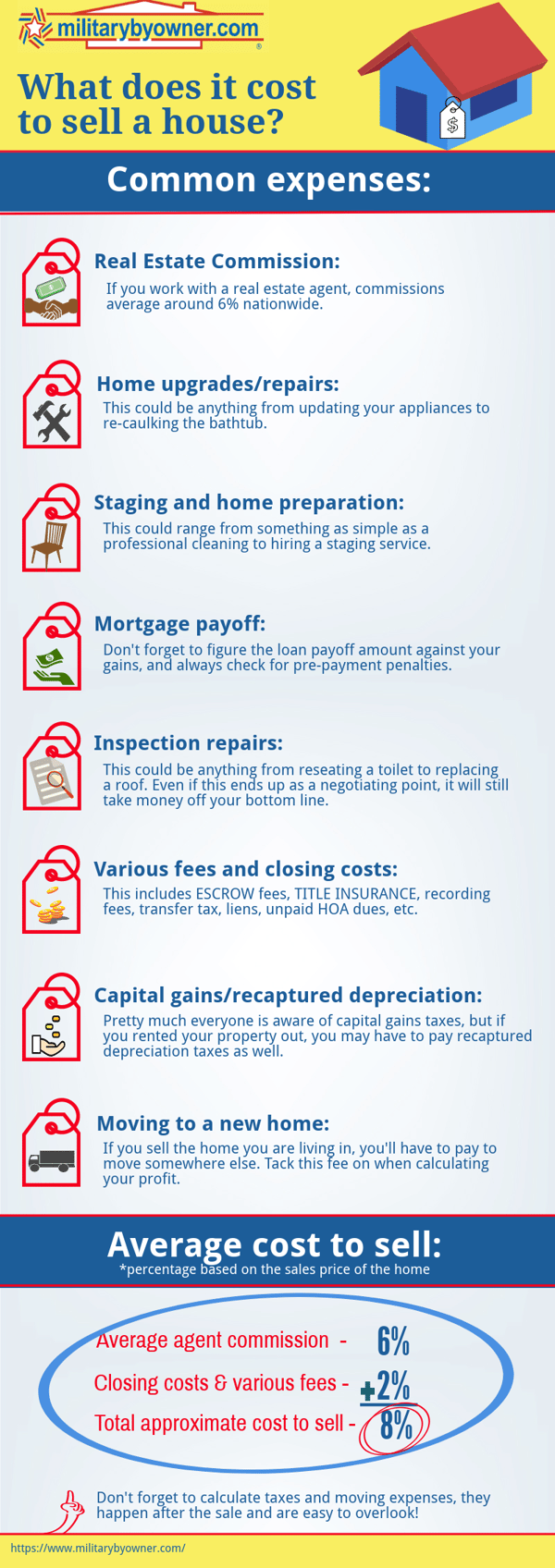

However, it's important to recognize that there’s more to the financial breakdown of a sale's cost than the agreed-upon sale price. Selling a home is a significant legal and financial undertaking, so it’s essential to be aware of your financial situation before agreeing to list your house for sale.

So, exactly how much are closing costs for sellers? Here’s a breakdown. You may also want to search for a "sell my home calculator" online if you prefer to add in your specific numbers.

1. Your Mortgage Pay-Off

One major aspect of a home sale that homeowners often overlook is the interest in arrears. Interest on a mortgage is paid for the previous month, so if you sell your home on the last day of a month, you will owe interest for that entire previous month.

Your title company will help you determine the mortgage pay-off amount and explain the discrepancy between what's shown on your lender’s website and the number they may have with accrued interest.

2. Liens Pay-Off

If you have a second mortgage, a Home Equity Line of Credit (HELOC), or a mechanics lien on your property for unpaid services rendered, these items will all appear in a title search. You’ll need to ensure that your title company works with you to pay these items from the closing proceeds.

3. Pre-Payment Penalty

We don’t often see many of these in post-recession home sales; however, for some homes purchased in the early 2000s, pre-payment penalties occurred on a number of mortgages. If you purchased your property before 2008, review your mortgage settlement statement (formerly known as the HUD-1) to check if any such penalties are listed.

4. Annual Property Taxes

Depending on your state, you might owe taxes for the entire year or a prorated portion. Your real estate agent and title company are the best resources to advise you on this line item.

5. Home Seller's Title Insurance

You may negotiate this line item, but it varies according to state statutes. However, in some states, such as Texas, title insurance is offered at a fixed rate based on the property's square footage. You can negotiate to have either the buyer or the seller pay for this item, according to your state laws.

6. Escrow Fee

The title company charges an escrow fee for managing your escrow account, which varies widely from sale to sale. However, expect to pay an average of 1% to 2% of the purchase price. For example, if you purchase a house for $200,000, the escrow fees will range from $2,000 to $4,000.

7. Warranty Deed

The fee goes to the attorney who prepares the deed transferring property rights. Ideally, you want to convey a General Warranty Deed, which allows for the easiest transition of the property with a free and clear status.

8. Recording Fee

This fee provides for the costs associated with the public recording of the deed transfer. You’ll pay the local government, whether it's the county or the city. Typically, fees are around $125.

9. Survey

This charge can be reduced in various cases. Some examples: if your survey is less than 10 years old, if you haven’t made any structural changes such as adding a shed on the foundation or a patio, and if you can convey the survey with a notarized document. Ask your real estate agent for more advice on how to avoid this costly line item, if possible.

10. Termite Inspection

If your home buyer is using a VA loan, you'll be responsible for payment of the termite inspection, as well as remediation of any potential issues found on the termite inspection, as per the VA’s approval process. The termite inspection is a "VA non-allowable" charge for military homebuyers using their VA Home Loan benefit.

11. Home Warranty

Home warranties range from roughly $400 to $800, depending on coverage. You don’t have to purchase this for the homebuyer, but it’s a good idea.

Consider this: The Seller’s Disclosure is the number one document that home sellers are sued over after the sale of the home. If an issue arises with the property after the sale is finalized, the last scenario you want is for the new homeowner to turn to the disclosure documents to determine if legal action should be pursued.

Instead, it’s much better for the new homebuyer to pick up the phone and call the home warranty company to remedy any issues with the HVAC, garbage disposal, and so on. And really, even if the situation doesn’t deteriorate into a legal, messy issue, do you want to be dealing with phone calls about those items after the sale anyway?

Photo by RDNE Stock project from Pexels via Canva.com

Photo by RDNE Stock project from Pexels via Canva.com

12. Broker’s Commissions

One of the largest costs of the home selling transaction (after the mortgage pay-off, typically) involves the broker’s commissions. These fees cover the services rendered, including the protection of your legal and fiduciary interests, as well as marketing services and transaction coordination, to name a few.

If you're working with a real estate agent who provides you with the market value of your property based on a Comprehensive Market Analysis, request a net sheet that provides a complete breakdown of the cost of your transaction.

If, after reviewing the transaction costs, you have a net profit, then that's great! Keep that precise number in mind so that you know exactly what wiggle room you have in your budget for negotiation when it comes to the purchase price and any request for seller concessions to help the buyer with closing costs.

If you find that, after reviewing the transaction costs, you have a net loss, then you have several items to consider:

- Can you increase the price of the home slightly to cover the cost without impacting your market position?

- If the net difference isn't significant and you really want to sell, it may be worth coming out of pocket at closing to move on to the next chapter of your life.

- If the net difference is significant, then your best option is to convert the home to a rental and wait until the market appreciates sufficiently for you to sell.

Whatever home selling decision you make, we’ve got the resources to support you. See our free home selling guide below, then stay up to date with our resource section and blog posts for additional guidance.