What Home Sellers Should Expect at Closing

You’ve put in the sweat, and it’s finally paid off. After lots of open houses, photos, offers, negotiations, and repairs, you’ve found the right buyer and it’s time to seal the deal and sell your home.

If it’s been a while since you’ve been through the home selling process, you may have a few questions. So, consider this a refresher to prepare for your upcoming closing date!

What Home Sellers Should Expect at Closing

What is closing?

In short, closing is everything that happens between when you accept an offer on the home and when you transfer ownership and keys to the buyer.

The closing date is the final step of the incredibly intricate home sale transaction. It’s when all negotiations written in the sales contract are fulfilled and all documents and money are transferred so that you, the home seller, can hand over ownership of the property to the buyer.

After all the showings, the back and forth negotiations, and the updates and repairs, this is the part where you can walk away and breathe easy.

How much does closing cost?

Closing on a home isn’t free even when you’re the seller. There are a lot of people and parts involved with a home sale transaction, and it’s your (and the buyer's) job to cover the financial responsibility.

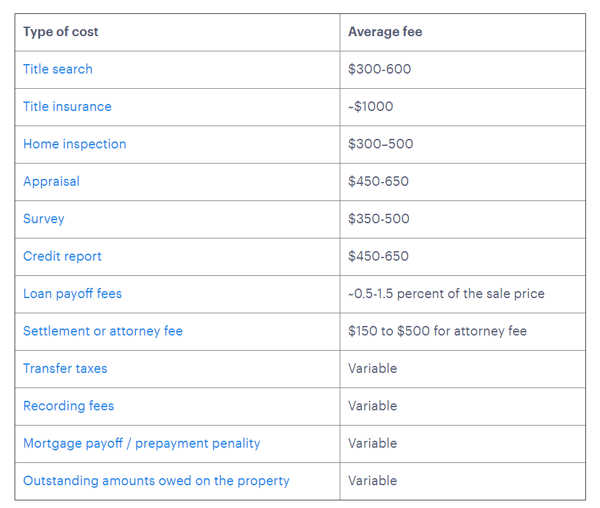

We'll break down each of the fees below, but for visual learners, here's a chart provided by Open Door. The average fees were gathered from Realtor.com, Money Crashers, nerdwallet, Bankrate, and Marketwatch. Check these sites for closing cost calculators which can help you determine what fees you'll be responsible for.

Closing Costs Broken Down

Title search. A title search ensures that you, the seller, are the rightful owner of the property and that there are no outstanding claims.

Title insurance. The lender and buyer typically purchase title insurance policies to protect their investment should an issue arise after the sale.

Home inspection. Just as it sounds, a home inspection is a professional inspection of the property and ensures the structural integrity of the home.

Appraisal. An appraisal verifies that the property is worth the value that the buyer is borrowing from the lender.

Survey. A survey reveals the property’s boundaries. It’s important since many states require a record for loans.

Credit report. Lenders run a credit report on the buyer to ensure that the buyer handles their debt responsibly.

Loan payoff fees. Loan payoff fees include loan application and assumption fees, prepaid interest, and loan origination fees.

- Loan application: This fee is non-refundable (even if the buyer isn’t approved for the loan) and varies in price depending on the lender. However, you can expect it not to exceed $500.

- Assumption fee: Quicken Loans shares that “if you’re assuming a conventional loan from the seller, you’ll pay an assumption fee set by the lender, typically $800 to $1,000, or in some cases 1% of the loan amount. For FHA loans, the maximum allowed is $500, and for VA loans, the max is $300.”

- Loan origination fee: This fee is a percentage of the loan amount and is paid to the lender.

Settlement or attorney fees. The attorney or escrow agent assisting in the closing doesn’t work for free. The settlement fee goes to them and is approximately $2 per $1,000 in sale price.

Recording fees. The paperwork has to get filed and that doesn’t happen for free! Each county sets the price for filing the deed for transfer to the buyer, so the cost will vary depending on your location.

Transfer taxes. Just like any sales transaction, you might be required to pay taxes. This amount is based on the property’s value and your local laws.

Mortgage payoff/prepayment penalty. If there’s anything left on your mortgage, this is the time to settle it. However, some lenders charge a penalty fee for paying off your loan early. The penalty varies based on your lender. Some require a percentage of the remaining amount owed, while others determine the fee based on the age of the loan.

Outstanding amounts owed on property. Owning a home comes with a variety of expenses. Beyond the largest check you write each month, the mortgage, there are utilities, property taxes, homeowners insurance, and possibly HOA fees. These expenses will need to be paid up to date and will, of course, be prorated to the closing date.

Who pays the closing costs?

Both the seller and the buyer cover closing costs. However, according to nerdwallet, the seller is usually on the hook for real estate agent commissions and additional fees like:

- Title insurance for the buyer

- Outstanding amounts owed on the property

- Mortgage payoff/prepayment penalty (if it applies)

- Transfer taxes and recording fees

- Attorney fees (if it applies)

- Necessary repairs after the home inspection.

Occasionally, the buyer can negotiate with the seller to pay part of the buyer’s portion. However, that doesn’t happen often.

What happens to your mortgage?

In most cases, you have to own an item to sell it. However, when it comes to selling your property, the rules bend a little. It’s okay to still have a balance on your mortgage. But, you need to pay it off at closing.

Order a payoff statement from your lender before closing to get an idea of what you owe to help get a better idea of how much you’ll walk away with and allow you to budget accordingly. However, the statement is only good for about 10 to 30 days. After the window closes, the lender will calculate interest and the balance will change.

You’ll also want to check with you lender to see if there are any of those prepayment penalties that we touched on earlier so you can factor that into your budget as well.

If your mortgage is paid off by the time of closing, congrats! Unless there are prepayment penalties, paying off your mortgage before closing can save you interest and other fees associated with paying off your mortgage at the time of closing.

Plus, you’re walking out of closing with a whole lot more money than if you had to write a check for the remaining balance of your loan to your lender.

Closing from a distance. If you’re a military homeowner then there’s a solid chance that you’ll need to close remotely.

Often, the buyer needs to be present at closing to sign the original loan documents. But as the seller, you should be able to handle the sale from wherever you’re off to next.

And there’s a basic set of rules to follow:

- Find an experienced real estate agent. They’ll be better equipped to help you in a non-traditional closing and juggle multiple time zones.

- Find out if you can pre-sign the deed and transfer of other documents.

- Prepare for signing. The agent will send all of the pages of the contract to be verified by an e-signature system. However, closing attorneys require physical signatures, so the agent will also work with the attorney to find the best mailing solutions.

- Set up the wire transfer of funds.

What You Can Do to Prepare for Closing

Usually, home sellers must have their belongings out of the property before the closing date. Here are a few things to help you get prepared for that final date:

- Gather documents.

- Shut everything off.

- Gather keys, manuals, and warranty info.

- Cancel insurance.

- Close accounts.

- Submit a change of address.

Frequently Asked Questions about Home Closing

How long does it take to close? Most home sales close within 30 days.

Is the money I make on my home sale taxable? Yes. The IRS calls the money you make in your home sale capital gain. However, just like anything else you pay taxes on, you might be eligible for a tax break or a capital gain tax exemption. The IRS gives a little extra grace to military home sellers with the extended duty exemption.

As you’re preparing your finances and looking to invest in your next home or stash your profit away for retirement, be sure to check out The Effect of Capital Gain Tax Exclusions on Military Home Sellers and find out if you qualify.

What do I need to have with me? Don’t show up empty handed! In order to finalize the sale of your home, you’ll need to bring a few things with you:

- Photo ID

- Copy of ratified sales contract

- Keys: house, garage, gate, and pool

- A cashier’s check (if the closing costs are not deducted from the sale’s price) or proof of wire.

For even more info on what to expect on closing day, be sure to read What to Expect When You Close on a Home.

It’s a lot, right? Understanding what it takes to close on your home requires knowledge you don’t likely keep in the forefront of your mind. Thankfully, the real estate professionals involved in the sale are educated, experienced, and there to help. Visit the MilitaryByOwner Business Directory to find a professional in your area!